AML training is a legal requirement in the U.S. under laws like the Bank Secrecy Act (BSA) and the Anti-Money Laundering Act of 2020. It ensures employees understand how to detect and prevent financial crimes like money laundering and terrorist financing. Non-compliance can lead to severe penalties, including fines of up to $1 million for institutions and $500,000 for individuals, as well as potential prison time.

Here’s what you need to know:

- Who Needs Training? All employees involved in AML compliance, including frontline staff, senior management, and the board of directors.

- Frequency: Annual training is mandatory, with updates for regulatory or business changes.

- Key Topics: BSA regulations, identifying suspicious transactions, internal policies, and customer due diligence.

- Customization: Training must align with your institution's risks, such as customer base, geographic location, and services offered.

- Recordkeeping: Maintain detailed records of training sessions, materials, attendance, and updates for audits.

AML training isn’t optional. It’s a critical component of compliance programs and must be updated regularly to reflect evolving regulations and risks. Failure to comply can result in enforcement actions, reputational damage, and hefty fines.

Anti-Money Laundering (AML) Training | Course Introduction

US Regulatory Framework for AML Training

AML training in the U.S. is built on two key foundations: federal regulations from FinCEN and industry-specific standards from FINRA. Together, these frameworks make training a mandatory part of every compliant AML program - it's not optional.

FinCEN Guidelines for AML Compliance

Under the Bank Secrecy Act (BSA), FinCEN mandates that training is a core part of an AML compliance program. Specifically, 31 CFR § 1022.210 requires businesses, including money services businesses (MSBs), to provide training for personnel involved in BSA/AML compliance. This includes senior management, the board of directors, the BSA compliance officer, and BSA agents.

"A principal must conduct independent testing to ensure there are no material weaknesses (e.g., inadequate training) or internal control deficiencies." - FinCEN Guidance FIN-2016-G001

Training programs must cover several key areas: employee responsibilities, internal policies, and methods for identifying suspicious transactions. Importantly, these programs must be tailored to the organization's specific risks, which can vary based on jurisdiction, products, services, and client base.

Documentation is a must. Businesses need to keep detailed records of training materials, testing results, session dates, and attendance for audit purposes. FinCEN also emphasizes the need for regular training updates to reflect changes in regulations or the organization's risk profile. It’s worth noting that neither principals nor agents can shift liability through contractual agreements.

While FinCEN sets the federal baseline, FINRA establishes additional standards specifically for broker-dealers.

FINRA and AML Program Standards

FINRA Rule 3310(e) applies to all broker-dealers and member firms, requiring ongoing training for personnel involved in AML compliance. This rule is comprehensive, covering every broker-dealer without exception.

"Provide ongoing training for appropriate personnel;" - FINRA Rule 3310(e)

FINRA’s requirements align closely with FinCEN’s but also include additional, industry-specific expectations. For example, training must address the "fifth pillar" of FinCEN's Customer Due Diligence (CDD) Rule, which involves risk-based procedures for ongoing customer due diligence and understanding customer risk profiles. It should also incorporate red flags highlighted in FINRA Regulatory Notices, such as those related to low-priced securities fraud, new account fraud, and cyber-enabled crimes.

Independent testing of an AML program is another critical requirement. Most firms must conduct this testing annually to ensure the adequacy of their training and overall compliance. Firms that don’t execute transactions or hold customer accounts may test every two years. Additionally, senior management must approve the AML program in writing and complete foundational training to effectively oversee the firm’s risk profile.

| Requirement Category | FinCEN/Regulatory Expectation |

|---|---|

| Core Requirement | Develop a written AML program that includes a training component. |

| Content | BSA compliance, internal policies, and suspicious activity detection. |

| Audience | All personnel with BSA-related responsibilities, including senior management. |

| Frequency | Regular updates prompted by regulatory or business changes. |

| Recordkeeping | Maintain records of training materials, attendance, and session dates for audits. |

Core Elements of an AML Training Program

A strong AML (Anti-Money Laundering) training program is built on three essential components. These pillars are critical to preventing money laundering and ensuring compliance, and regulators expect to see them in place during examinations.

Risk-Based Policies and Procedures

Every business faces unique money laundering risks, shaped by factors like customer demographics, geographic locations, and the types of products or services offered. Because of this, AML training must address these specific risks instead of relying on generic content. The key is to align training with the specific roles and responsibilities of employees.

"Training should be tailored to each individual's specific responsibilities, as appropriate." - FFIEC BSA/AML Manual

For example, if your firm engages in foreign correspondent banking or private banking, these areas require more in-depth and specialized training. A formal, written risk assessment should guide the training content, ensuring that employees are equipped to handle the highest-risk areas. This assessment should be updated whenever new business lines are introduced or new advisers join the team.

Once risks are identified, training programs must focus on equipping employees with the tools and knowledge to address and mitigate these risks effectively.

Employee Training and Awareness

AML training isn’t a one-and-done process. Employees are required to complete annual training to stay updated on regulatory changes, new fraud schemes, and internal policy updates. For new hires, foundational BSA (Bank Secrecy Act) training should take place during orientation or shortly after they start.

The training curriculum should focus on three main areas:

- Legal and regulatory requirements under the Bank Secrecy Act.

- Techniques for identifying and preventing money laundering, including spotting red flags.

- Internal procedures for reporting suspicious activities.

It's not just frontline employees who need training. Board members and senior managers must also undergo foundational AML training to ensure they can provide effective oversight.

To demonstrate compliance, keep detailed records of all training sessions and attendance. Regulators and auditors will often request these records during reviews.

Independent Testing and Auditing

Independent testing is a vital part of AML compliance. It ensures that policies and procedures are not just written but are also being implemented effectively. For firms handling customer transactions, testing should occur annually. For those without transactions, testing is required every two years.

"The mantra of an AML/CFT audit is 'don't tell me, show me.'" - Giulia Dondoli, AML Specialist, Total AML

To maintain objectivity, the person conducting the testing must be completely independent. They cannot be the AML Compliance Officer, perform the tasks being tested, or report to someone involved in those functions. Additionally, the tester should have a deep understanding of the BSA and related regulations.

Auditors evaluate several aspects, including whether employees completed their training and whether the training materials were specific to the identified risks. They also ensure that technical systems are functioning properly. High-quality independent testing can benefit your firm, as regulators may adjust the scope of their review based on the reliability of your internal testing program.

Who Needs AML Training and How Often?

Determining who needs Anti-Money Laundering (AML) training and how often it should occur is a key part of staying compliant. In the U.S., regulations mandate AML training for all employees involved in Bank Secrecy Act (BSA) and AML compliance. This includes front-line staff like tellers and customer service representatives, who are often the first to spot red flags in transactions or customer behavior. Employees in specialized areas - such as lending, trust services, private banking, and foreign correspondent banking - also need training tailored to the unique risks they face. Whenever there are major regulatory updates or internal policy changes, these groups must promptly refresh their training.

Support teams, including those in risk management, legal, and accounting, are not exempt - they also need AML training. If your organization works with third-party agents for BSA-related tasks, it's your responsibility to ensure they are properly trained as well.

Leadership plays an equally important role in AML compliance. The Board of Directors and senior management need foundational training to understand the institution's risk profile and BSA requirements. The FFIEC BSA/AML Manual emphasizes:

While the board of directors may not require the same degree of training as banking operations personnel, the training should provide board members with sufficient understanding of the bank's risk profile and BSA regulatory requirements.

This knowledge helps leadership oversee compliance efforts effectively and allocate resources where needed.

As for training frequency, all relevant employees are required to complete AML training annually. New hires should receive an introductory overview during their orientation. Meanwhile, BSA Compliance Officers and AML specialists need periodic updates to stay current with regulatory changes and emerging risks.

Lastly, don’t overlook the importance of recordkeeping. Proper documentation of training is essential for regulatory audits.

sbb-itb-d1a6c90

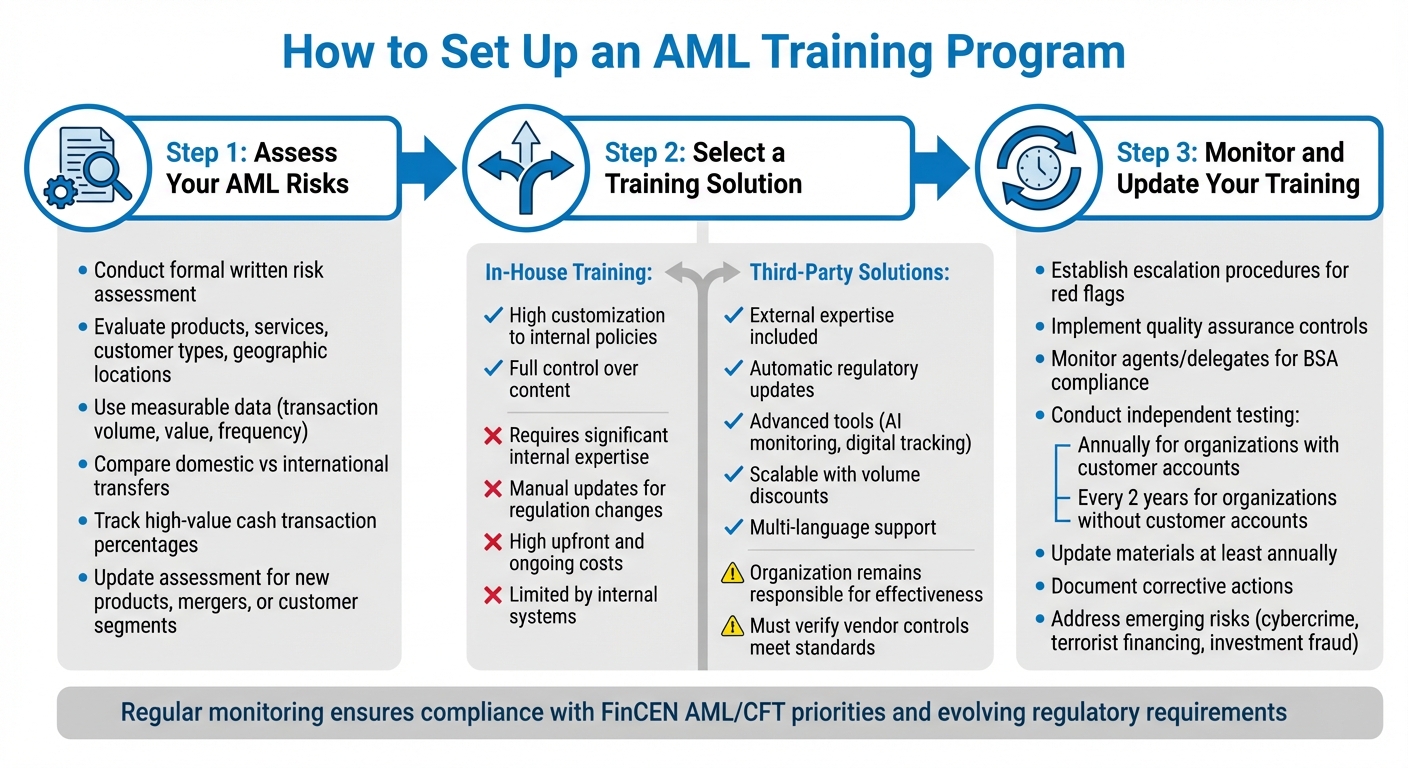

How to Set Up an AML Training Program

3-Step AML Training Program Implementation Guide

Creating a solid AML (Anti-Money Laundering) training program requires a focused, risk-based approach tailored to the specific vulnerabilities of your organization. Here’s a step-by-step guide to help you get started.

Step 1: Assess Your AML Risks

Start by evaluating your organization’s AML risks. A formal, written risk assessment is crucial. This assessment should cover key areas like products, services, customer types, and geographic locations. Use measurable data - such as transaction volume, value, and frequency changes - to pinpoint potential vulnerabilities.

For example, compare domestic and international transfer volumes or track the percentage of high-value cash transactions. If your organization introduces new products, undergoes mergers, or expands into new customer segments, update your risk assessment promptly to reflect these changes.

Once you have a clear understanding of your risks, the next step is to choose the best training method to address them.

Step 2: Select a Training Solution

With a clear risk profile in hand, decide how to deliver your AML training. You have two main options: in-house training or outsourcing to a third-party provider.

In-house training gives you full control and allows you to customize the content to align with your internal policies and processes. However, this approach requires significant internal expertise and resources to keep materials updated whenever regulations change.

Third-party training solutions bring external expertise and often include advanced tools like AI-powered monitoring and digital tracking. These solutions automatically update content to reflect new laws and scam trends, easing the maintenance burden. However, it’s essential to ensure the vendor’s controls meet regulatory standards and to document the arrangement thoroughly. Remember, even if you outsource training, your organization remains responsible for the program’s overall effectiveness.

Here’s a quick comparison of the two options:

| Feature | In-House Training | Third-Party Training Solutions |

|---|---|---|

| Customization | High; tailored to internal policies. | Moderate to high; includes industry-specific modules. |

| Maintenance | Requires manual updates for regulation changes. | Automatically updated to reflect new laws. |

| Technology | Limited by internal systems. | Often includes advanced tools like RegTech. |

| Cost | High upfront and ongoing costs. | Scalable with potential volume discounts. |

Whichever option you choose, make sure the training platform provides digital attendance records and completion data for audits. If your workforce includes remote or home-office staff, ensure the platform is easily accessible and offers multi-language support, such as English and Spanish.

After setting up your training method, the next step is to continuously monitor and refine the program.

Step 3: Monitor and Update Your Training

Launching your AML training program is just the beginning. Regular monitoring is essential to keep up with regulatory updates and emerging risks. For instance, FinCEN has integrated government-wide AML/CFT priorities - such as combating cybercrime, terrorist financing, and investment fraud - into risk-based program requirements.

Establish clear escalation procedures to ensure red flags identified by business units are quickly communicated to your AML or compliance team. Use internal quality assurance controls to review and update training materials as needed. If your organization relies on agents or authorized delegates for BSA-related tasks, implement risk-based procedures to monitor their activities and ensure they comply with your policies.

Independent testing of your AML program is typically required annually. However, organizations without customer accounts may only need testing every two years. These audits help identify weaknesses, such as gaps in training or internal controls. When issues are found, document the corrective actions taken. This not only prepares you for regulatory audits but also demonstrates your commitment to managing compliance obligations effectively.

Common Mistakes and Best Practices in AML Training

Once you've set up your AML training program, it's crucial to recognize common missteps and adopt practices that keep your program effective and compliant.

One major mistake businesses often make is using generic, one-size-fits-all training content. Different roles within an organization face unique risks. For instance, tellers need to focus on currency transactions, while loan officers should concentrate on lending-related risks. Another common issue is relying on outdated materials, which can lead to compliance gaps. These gaps often arise when training fails to reflect recent regulatory updates, new supervisory guidance, or changes in a business's risk profile - like launching new products or expanding into different regions. Poor documentation practices only make these problems worse.

"Training should be tailored to each individual's specific responsibilities, as appropriate. In addition, targeted training may be necessary for specific ML/TF and other illicit financial activity risks." - FFIEC

To sidestep these pitfalls, create role-specific training modules tailored to the needs of each department. Clearly define escalation procedures so employees understand how to report suspicious activities to the AML team. Make sure to track attendance diligently and enforce corrective actions for missed sessions. Your training should also address emerging risks, such as cyber-related incidents and securities fraud, to stay ahead of evolving threats.

Regularly review and update your training materials - at least once a year or whenever there are significant changes to your business model. If your organization uses agents for BSA-related tasks, remember that you are still responsible for ensuring they receive the proper training.

Conclusion

AML training isn’t just a box to check - it’s a legal requirement under the Bank Secrecy Act and specific regulations like FINRA Rule 3310 and sections of 12 CFR (e.g., 12 CFR 208.63). Skipping this crucial step puts your business at risk of enforcement actions, hefty fines, and reputational hits. These consequences can be especially damaging during mergers, where regulators closely examine your AML compliance track record.

The key to effective AML training lies in tailoring it to specific roles and risks. For instance, tellers need to recognize suspicious cash transactions, while loan officers should grasp the risks tied to lending practices. Board members, on the other hand, require foundational knowledge to oversee compliance programs effectively and ensure the allocation of adequate resources to AML efforts using board management platform essentials.

"Without a general understanding of the BSA, it is more difficult for the board of directors to provide adequate oversight of the BSA/AML compliance program, including approving the written BSA/AML compliance program, establishing appropriate independence for the BSA/AML compliance function, and providing sufficient BSA/AML resources." - FFIEC

AML training isn’t a one-and-done task. Regulations shift, businesses evolve, and financial crime tactics grow more sophisticated. To keep up, your training materials should be updated at least annually. It’s also crucial to document attendance and training sessions thoroughly and ensure your program aligns with the latest supervisory guidance. Federal examiners are required to attend annual training on financial crime patterns - your team should aim to do the same to stay ahead.

FAQs

What happens if a business doesn’t comply with AML training requirements?

Non-compliance with AML training requirements can lead to serious repercussions for businesses. These can range from steep fines and civil penalties to sanctions and, in extreme cases, the revocation of licenses or regulatory approvals. Beyond the financial and operational impact, such failures can tarnish a company’s reputation, making it harder to function effectively in regulated industries.

To mitigate these risks, businesses must ensure employees receive thorough AML training and remain aligned with the latest compliance standards. Staying proactive in this area is key to safeguarding both your operations and reputation.

How can businesses tailor AML training to address their specific risks?

To create effective AML training, businesses should begin with a thorough risk assessment. This helps pinpoint potential money-laundering or terrorist-financing threats tied to their specific products, customers, locations, and operations. From there, training can be customized to fit the responsibilities of different roles. For instance, front-line staff might focus on customer onboarding scenarios, while compliance teams dive into regulatory requirements and emerging threats. Areas with higher risks, like foreign banking or trust services, may need more advanced, scenario-driven training.

It's crucial to regularly update the training program, especially when regulations shift or the company enters new markets. New employees should start with a solid introduction to AML requirements, while periodic refresher courses keep the entire team aware of new risks and trends. Tracking training completion and identifying knowledge gaps ensures the program stays effective and aligns with the organization's risk landscape.

For added support, BizBot offers a directory of compliance tools to help businesses streamline AML training and automate tracking. These tools make it easier to stay on top of regulatory requirements without added hassle.

What’s the difference between in-house and third-party AML training?

In-house AML training is created and delivered directly by the organization, making it possible to tailor the content to match the company’s unique risk profile, policies, and employee responsibilities. This personalized approach ensures the training aligns closely with internal procedures and can even incorporate proprietary case studies. However, it does come with a tradeoff: developing, updating, and implementing such programs demands a significant investment of time and resources.

Third-party AML training, by contrast, involves pre-designed courses provided by external experts. These programs often include self-paced online modules or instructor-led sessions that are regularly updated to reflect the latest regulations and industry practices. They’re convenient and ready to use, but they might not address a company’s specific processes as deeply as an in-house program.

Each option has its advantages. In-house training allows for customization, while third-party solutions save time and offer standardized, regulator-compliant materials. If you're looking for third-party providers or tools to enhance your in-house training, BizBot offers a detailed directory of business solutions to help you find the right fit.

![Thumbnail for: Compliance Training 101: Complete Guide [2024]](https://mars-images.imgix.net/seobot/bizbot.com/6666495f0f868443fbdadd05-4e74f54c55cc663677c1edb0c1fddc8c.png?auto=compress)