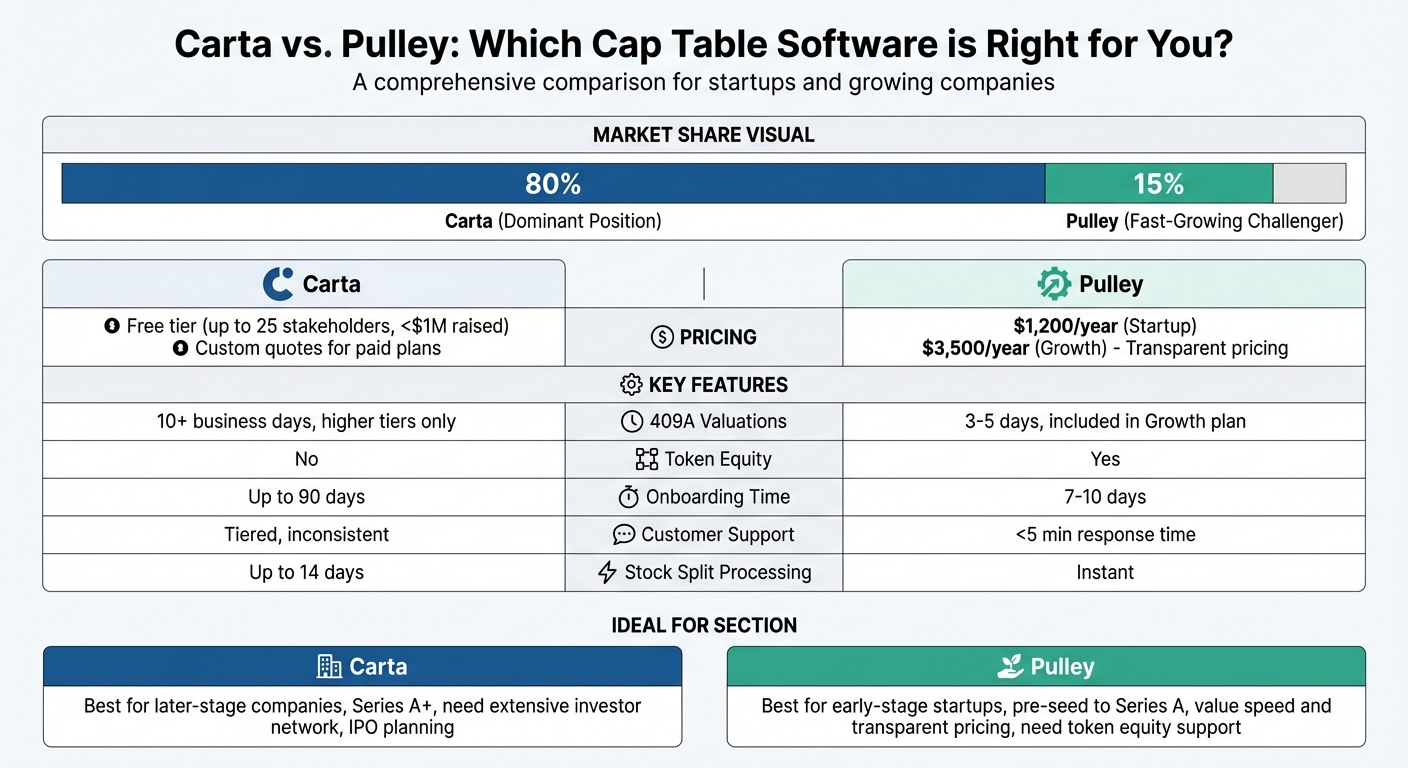

Managing your company's cap table is essential as you grow. Carta and Pulley are two major platforms designed to simplify this process. Here's a quick breakdown of their offerings:

- Carta: Dominates the market with 80% share. Offers a free plan for startups with up to 25 stakeholders and less than $1M raised. Paid plans include advanced features like 409A valuations and IPO support but require custom quotes. Known for its integrations with investors and law firms, Carta suits larger companies but has slower processes and higher costs as you scale.

- Pulley: A newer player with 15% market share. Transparent pricing starts at $1,200/year, with faster 409A valuations (3-5 days) and built-in support for token equity. Pulley focuses on speed, ease of use, and predictable costs, making it ideal for early-stage startups.

Quick Comparison

| Feature | Carta (Launch) | Carta (Paid Plans) | Pulley (Startup) | Pulley (Growth) |

|---|---|---|---|---|

| Annual Price | Free | Custom Quote | $1,200 | $3,500 |

| Stakeholder Limit | Up to 25 | 50+ | Up to 25 | Up to 40 |

| 409A Valuations | Not Included | Included (Higher Tiers) | Not Included | 2 per year |

| Token Equity Support | No | No | Yes | Yes |

| Customer Support | Tiered | Tiered | <5 min response | <5 min response |

Choose Carta if you're a larger company or need extensive integrations. Choose Pulley if you're an early-stage startup looking for speed, simplicity, and transparent pricing.

Carta vs Pulley Cap Table Software Comparison Chart

What Software Is Used For Cap Tables? - BusinessGuide360.com

sbb-itb-d1a6c90

Pricing Comparison

When it comes to pricing, the two platforms take very different approaches. Carta offers a free Launch tier for companies with up to 25 stakeholders and less than $1 million raised. Beyond this, pricing depends on a custom quote from their sales team for the Build, Grow, or Scale tiers. These paid plans use a price-per-stakeholder model with a minimum annual fee.

Pulley, on the other hand, provides clear and fixed pricing. Its Startup plan costs $1,200 annually for up to 25 stakeholders, while the Growth plan is priced at $3,500 per year for up to 40 stakeholders. For additional stakeholders, Pulley charges about $4 each, and angel investors writing checks of $50,000 or less count as only half a stakeholder.

The differences in pricing become even more noticeable when you factor in 409A valuations - IRS-required appraisals for pricing employee stock options. With Carta, 409A valuations are included only in the higher Grow and Scale tiers. Pulley, however, includes two 409A valuations annually with its Growth plan, potentially saving companies thousands compared to standalone valuation costs. Pulley also delivers these valuations quickly, typically within 3 to 5 days, whereas Carta can take over 10 business days.

"Carta offered me a free year, yet I chose to pay for Pulley. At the end of the day, it's the human element that really matters." – Brittani McCall, CEO and Co-Founder, FlowEQ

For early-stage companies with fewer than 25 stakeholders, Carta's free tier offers a compelling starting point. However, many users report that costs rise steeply as the company grows. Pulley, by contrast, maintains predictable pricing and even offers specialized Token Cap Table plans for businesses with international or crypto-specific needs, priced at $4,500 annually.

Here’s a closer look at the pricing structures of each platform.

Carta Pricing

Carta structures its plans into four tiers, but only the Launch plan has public pricing. This free plan is tailored to companies with up to 25 stakeholders and less than $1 million raised. It includes basic cap table management, SAFE modeling, and standard compliance forms like 83(b) elections.

Once these thresholds are exceeded, companies must upgrade to paid tiers - Build, Grow, or Scale - requiring a custom quote. The Build tier supports up to 50 stakeholders and introduces features like white-glove onboarding and priced round modeling. The Grow and Scale tiers expand stakeholder limits and add advanced tools such as 409A valuations, board management, ASC 718/IFRS reporting, and IPO advisory services. Industry estimates indicate that these plans start at approximately $6 per stakeholder per month. Carta also offers optional add-ons like Total Compensation for benchmarking, Equity Advisory for tax planning, Liquidity for tender offers, and QSBS Attestation, which can increase overall costs.

Pulley Pricing

Pulley keeps things straightforward with three pricing tiers. The Startup plan is $1,200 per year and includes cap table management, share certificates, and templates for SAFEs, options, and RSAs. This plan is ideal for early-stage companies but does not include 409A valuations.

The Growth plan costs $3,500 annually and supports up to 40 stakeholders. It includes all Startup features plus two annual 409A valuations (delivered in 3 to 5 days), custom agreements, option exercises, Rule 701 compliance, Form 3921 reporting, and HRIS integrations. For larger businesses, Pulley's Enterprise plan offers custom pricing and advanced capabilities like ASC 718 reporting and secondary liquidity solutions. Pulley also caters to crypto startups with specialized plans - Token Cap Table and Token Distributions - priced at $4,500 per year for 25 stakeholders, with additional stakeholders costing around $4 each.

Pricing Comparison Table

Here’s a quick side-by-side comparison of the pricing and features:

| Feature | Carta (Launch) | Carta (Build/Grow/Scale) | Pulley (Startup) | Pulley (Growth) |

|---|---|---|---|---|

| Annual Price | Free | Contact Sales | $1,200 | $3,500 |

| Stakeholder Limit | Up to 25 | 50 to Flexible | Up to 25 | Up to 40 |

| Fundraising Cap | < $1M raised | No limit | No limit | No limit |

| 409A Valuations | Not Included | Included (Grow/Scale only) | Not Included | 2 per year included |

| Fundraising Models | Basic SAFE modeling | Priced Round Modeling | Included | Included |

| Onboarding | Standard support | White-glove onboarding | Concierge onboarding (7–10 days) | Concierge onboarding (7–10 days) |

| Angel Investor Discount | None | None | Yes (≤ $50k = 0.5 stakeholder) | Yes (≤ $50k = 0.5 stakeholder) |

| Additional Stakeholder Cost | Opaque | Opaque | ~$4 each | ~$4 each |

This breakdown highlights the pricing structures and key cost components for both platforms, setting the stage for a deeper dive into their features and capabilities.

Features and Capabilities

Both Carta and Pulley tackle essential tasks like cap table management, equity grants, and compliance tracking, but they differ significantly in how they handle speed, equity types, and critical operations such as valuations and reporting. Here's a closer look at what sets each platform apart.

Carta commands an impressive 80% market share, serving over 1.6 million stakeholders. Its standout features include a robust investor network and sophisticated modeling for complex tax scenarios. Carta also integrates deeply with major law firms and venture capital networks through its "Startup Stack" ecosystem. However, some processes can be clunky - option grants require DocuSign, and stock splits can take up to 14 days. While ASC 718 reports are automated, they often lack the detailed formulas needed for smooth audits.

Pulley, on the other hand, takes a founder-centric approach, emphasizing speed, ease of use, and support for token-based compensation. It simplifies processes like option grants by including built-in, legally binding signatures - no external tools needed. Stock splits are processed instantly, and 409A valuations are delivered in just 3 to 5 business days, far faster than Carta's 10-day average. Pulley’s ASC 718 reports are fully formulated, making them audit-ready from the start.

"Equity management becomes exponentially complex as you scale. We chose Pulley because they turned that complexity into simplicity." – Karri Saarinen, CEO, Linear

This quote perfectly captures Pulley's focus on streamlining equity management, contrasting with Carta's more enterprise-oriented approach.

When it comes to fundraising modeling, Pulley offers real-time dilution scenarios, complete with pro-rata and YC rights support. Carta, while providing grouped ownership views, lacks such advanced tools in its lower-tier plans. Pulley also stands out by supporting token equity, managing vesting schedules, lockups, and distributions via blockchain integrations. Carta, by comparison, sticks strictly to traditional equity.

Feature Comparison Table

| Feature | Carta | Pulley |

|---|---|---|

| 409A Turnaround | ~10 business days | 3–5 business days |

| Token Equity Support | No | Yes (comprehensive) |

| Option Grant Signatures | Requires third-party tools | Built-in legally binding signatures |

| ASC 718 Reports | Automated, no formulas | Fully formulated, audit-ready |

| Stock Split Processing | Up to 14 days | Instant |

| Fundraising Modeling | Limited in lower tiers | Advanced pro-rata and YC rights support |

| Onboarding Time | Up to 90 days | ~10 days |

| Customer Support Response | Tiered/Inconsistent | Average <5 minutes |

Pulley’s focus on speed and simplicity, alongside its support for modern equity types like tokens, makes it a strong choice for startups looking to streamline operations. Meanwhile, Carta’s extensive integrations and enterprise-grade features cater to larger, more established companies.

Ease of Use and User Experience

Carta User Experience

Carta has built a reputation as a trusted platform among institutional investors, supporting more than 1.6 million equity holders. It's often seen as the go-to equity management tools in the industry. For instance, founder Almaw Molla shared that downloading a cap table on Carta took less than a minute - an invaluable feature during investor due diligence.

That said, Carta's rich feature set comes with a learning curve. Its interface can feel overwhelming, especially for early-stage founders. As Victor Gardrinier, co-founder of Solarmente, explained:

"Carta feels like it's the standard. If we were to use another tool, I don't know if investors would be as comfortable with it."

Pulley, on the other hand, takes a different approach, focusing on simplicity and ease of use for founders.

Pulley User Experience

Pulley prioritizes a founder-friendly design, offering a clean, drag-and-drop interface that simplifies equity management. Its step-by-step issuance flows make tasks like equity distribution straightforward, even for those without a technical background.

One area where Pulley shines is onboarding. While Carta's migration process can stretch up to 90 days for more complex setups, Pulley typically completes the process in just 7 to 10 days. This is achieved through a concierge-led approach that ensures a smooth transition. Balázs Scheidler, CEO of Axoflow, reflected on his experience, describing it as:

"simple, fast, and really smooth", and commending the helpful representative who guided his team through the setup process.

Pulley also excels in customer support, with average response times of under five minutes, a notable advantage for busy founders.

Scalability and Support

Scalability for Growth

When it comes to scalability, the differences between Carta and Pulley are hard to ignore. Carta dominates the market with over 80% share, making it the go-to platform for a wide range of companies - from early-stage startups to those gearing up for an IPO. Its ecosystem is packed with tools like 409A valuations, ESOP administration, and SPV formation, which have made it a natural choice for businesses raising Series A funding or beyond. Plus, its strong connections with venture capital firms add an extra layer of credibility during funding rounds. This scalability ties in neatly with the pricing and features already discussed.

Pulley, on the other hand, holds about 15% of the market and has been growing rapidly, with a 54.6% increase over the past three years. Pulley stands out for its speed and flexibility. For instance, it can execute stock splits instantly, while Carta might take up to 14 days to complete the same task. Pulley also offers hybrid, milestone, and time-based vesting options for all equity types within a single agreement - something Carta typically handles through separate agreements. Another standout feature? Pulley's ability to manage token cap tables with impressive efficiency. Its ASC 718 reports include full formulas, which makes auditing much simpler.

Customer Support

Customer support is another area where these platforms differ significantly. Pulley prides itself on fast and accessible support, with response times under five minutes via phone, email, or chat. Their team, staffed by experienced professionals, helps founders, stakeholders, and even third parties like law firms and auditors. Brittani McCall, CEO and Co-Founder of FlowEQ, shared her perspective:

"Carta offered me a free year, yet I chose to pay for Pulley. At the end of the day, it's the human element that really matters."

Carta, meanwhile, provides tiered 24/7 support, though response times can vary. For critical services like 409A valuations, Pulley delivers results within three business days, while Carta typically takes between 10 and 15 business days. Pulley's plans priced above $3,500 also include lifetime audit support, a benefit that Carta limits to its higher-tier "Grow" and "Scale" plans.

Conclusion and Recommendations

Summary of Key Points

When it comes to cap table management, each platform serves specific needs depending on a company's stage and growth goals. Carta has established itself as the go-to platform for venture-backed startups, particularly those progressing toward Series A and beyond. Its appeal lies in a well-rounded ecosystem, a vast network of investors, and features tailored for companies planning an IPO. However, onboarding can take up to 90 days, and pricing details are only available through custom quotes from sales teams, which might be a drawback for some companies [6, 24].

Pulley, capturing about 15% of the market, has been making significant strides, especially among Y Combinator startups, where it has more than doubled Carta's market share in recent cohorts [6, 24]. Pulley stands out with faster 409A valuations compared to Carta, quicker customer support response times, and transparent pricing starting at $1,200 annually for up to 25 stakeholders. Its G2 rating for "Quality of Support" is 9.6/5 versus Carta's 8.3/5, showcasing its commitment to user satisfaction [4, 18, 20]. These distinctions make it clear that each platform caters to different business needs and growth phases.

Which Tool is Right for You?

The choice between Carta and Pulley ultimately comes down to your company's stage and priorities.

Go with Carta if you're operating a later-stage company or if your investors prefer it. Carta’s expansive investor network and comprehensive features make it a strong fit for mid-sized and enterprise-level businesses. As Victor Gardrinier, Co-founder of Solarmente, put it:

"If we were to use another tool, I don't know if investors would be as comfortable with it or if they would like it. Carta feels like it's the standard".

Opt for Pulley if you're an early-stage founder, from pre-seed to Series A, and value transparent pricing and quick onboarding. Pulley’s "Instamigrator" tool ensures setup can be completed in just a few days, and its high support ratings reflect its focus on user experience. Additionally, Pulley offers token cap table management, a feature not available on Carta [4, 8, 20].

If you're looking for tools beyond cap table management, check out BizBot's curated directory of solutions. It includes options for accounting software, HR services, and ownership management tools tailored for freelancers, small business owners, and growing companies.

FAQs

How do Carta and Pulley differ in their pricing models?

When it comes to pricing, Carta and Pulley take different paths. Carta provides a free plan for companies with up to 25 stakeholders. Beyond that, its paid plans are tailored to each customer, with pricing determined by factors like the number of stakeholders or specific requirements. However, these prices aren’t publicly disclosed, making it harder to gauge costs upfront.

Pulley, in contrast, adopts a more straightforward pricing model with clearly defined tiers. Their Startup plan is priced at $1,200 per year for up to 25 stakeholders. For companies needing more capacity, the Growth plan costs $3,500 per year and supports up to 40 stakeholders. For larger operations, Pulley offers an Enterprise plan with customized pricing based on specific needs.

Both platforms provide free options for smaller teams, but Pulley’s transparent pricing structure gives businesses a clearer picture of what they’ll pay as they grow, unlike Carta’s more variable, quote-based system.

How quickly do Carta and Pulley provide 409A valuations?

Pulley usually provides 409A valuations in approximately three business days, making it a quick option for companies that need results promptly. In contrast, Carta does not publicly state a standard timeframe for completing 409A valuations based on the information available.

For businesses where timing is crucial, Pulley's faster turnaround could be an appealing choice.

Which platform is better for managing token equity: Carta or Pulley?

Pulley is frequently regarded as the go-to platform for managing token equity, especially for companies operating in the crypto and Web3 sectors. Its suite of tools is tailored to address the unique challenges of token ownership and equity distribution specific to these industries.

Although both Pulley and its competitors provide strong cap table management features, Pulley distinguishes itself by prioritizing the needs of businesses embracing emerging technologies and unconventional business models. This focus has made it a favored solution for startups in these cutting-edge fields.