Rebalancing your portfolio ensures your investments stay aligned with your financial goals and risk tolerance, even as markets fluctuate. Without it, your asset allocation can drift, exposing you to unintended risks. For example, a 60/40 stock-to-bond portfolio could shift to 65/35 during a bull market, increasing your exposure to equities.

Here’s what you need to know:

- What is Rebalancing? It’s the process of selling overperforming assets and buying underperforming ones to maintain your target allocation.

- Why Customize? Tailored strategies consider your goals, risk tolerance, tax impact, and account types.

- Methods to Use:

- Time-Based: Adjust on a fixed schedule (e.g., annually).

- Threshold-Based: Rebalance only when allocations deviate by a set percentage (e.g., ±5%).

- Hybrid: Combine scheduled reviews with deviation triggers.

- Cost Control: Use natural cash flows (like dividends) to minimize trading and tax costs.

A hybrid approach - such as annual reviews with a ±5% tolerance band - balances simplicity and cost efficiency. Use tools like automated platforms to streamline monitoring and execution. Regularly review your strategy to adjust for market changes or major life events.

Portfolio Rebalancing Explained | Strategies, Timing, & Risk Management

Setting Investment Goals and Target Allocations

To rebalance your portfolio effectively, you need a clear understanding of your financial goals and how much risk you're willing to take. Your target allocation - the specific mix of stocks, bonds, and other assets - acts as a roadmap for all your rebalancing decisions. Without defined goals and a clear allocation strategy, rebalancing becomes aimless. Start by identifying your financial objectives and risk tolerance to establish specific target allocations.

Identifying Your Long-Term Financial Goals

What are you saving for? Is it retirement in a few decades, a college fund for your children, or simply preserving the wealth you've built? Each goal comes with its own time horizon and priorities, which directly influence your asset allocation.

For example, younger investors often lean toward higher equity exposure to maximize growth potential. On the other hand, older investors may shift toward safer assets, like bonds, to protect their accumulated wealth. If you're 35 and focused on aggressive growth for retirement, you might aim to accumulate $1 million by age 65 with a target allocation of 80% stocks, 15% bonds, and 5% alternatives. If you're 60 and prioritizing stability, a more conservative allocation - such as 50% stocks, 40% bonds, and 10% cash - could help reduce volatility as retirement nears.

It's crucial to document your financial goals, including specific targets and deadlines. Revisit these annually or after major life changes like marriage, inheritance, or career shifts to ensure your allocations remain aligned with your objectives. Once your goals are in place, the next step is determining how much market fluctuation you can handle.

Determining Your Risk Tolerance

Risk tolerance - your ability to handle market ups and downs without undue stress - directly influences how much of your portfolio is allocated to equities versus fixed-income assets. Conservative investors with low tolerance often stick to 30-50% equities to limit potential losses, while moderate investors might aim for 50-70%. Aggressive investors, comfortable with higher volatility, could allocate 70-90% to equities.

To gauge your risk tolerance, consider using standardized questionnaires. These tools assess factors like your reaction to a 20% portfolio loss, your income stability, and your investing experience. Based on your responses, you'll receive a suggested allocation range. For instance, a conservative investor might end up with 40% U.S. bonds, 30% stocks, 20% international bonds, and 10% cash. An aggressive investor might lean toward 85% equities and 15% bonds, with specific thresholds to guide rebalancing.

Age also plays a key role. Younger investors under 40 generally have a higher risk tolerance and longer time horizons, which supports allocations of 80-90% equities with annual rebalancing to capture growth. In contrast, investors over 60 often shift to 40-50% equities, gradually adjusting their portfolios along a "glide path" to prioritize preservation. Once you've assessed your risk tolerance, set clear tolerance bands - typically ±5% from your target allocation - to determine when rebalancing is necessary.

Choosing Your Rebalancing Method

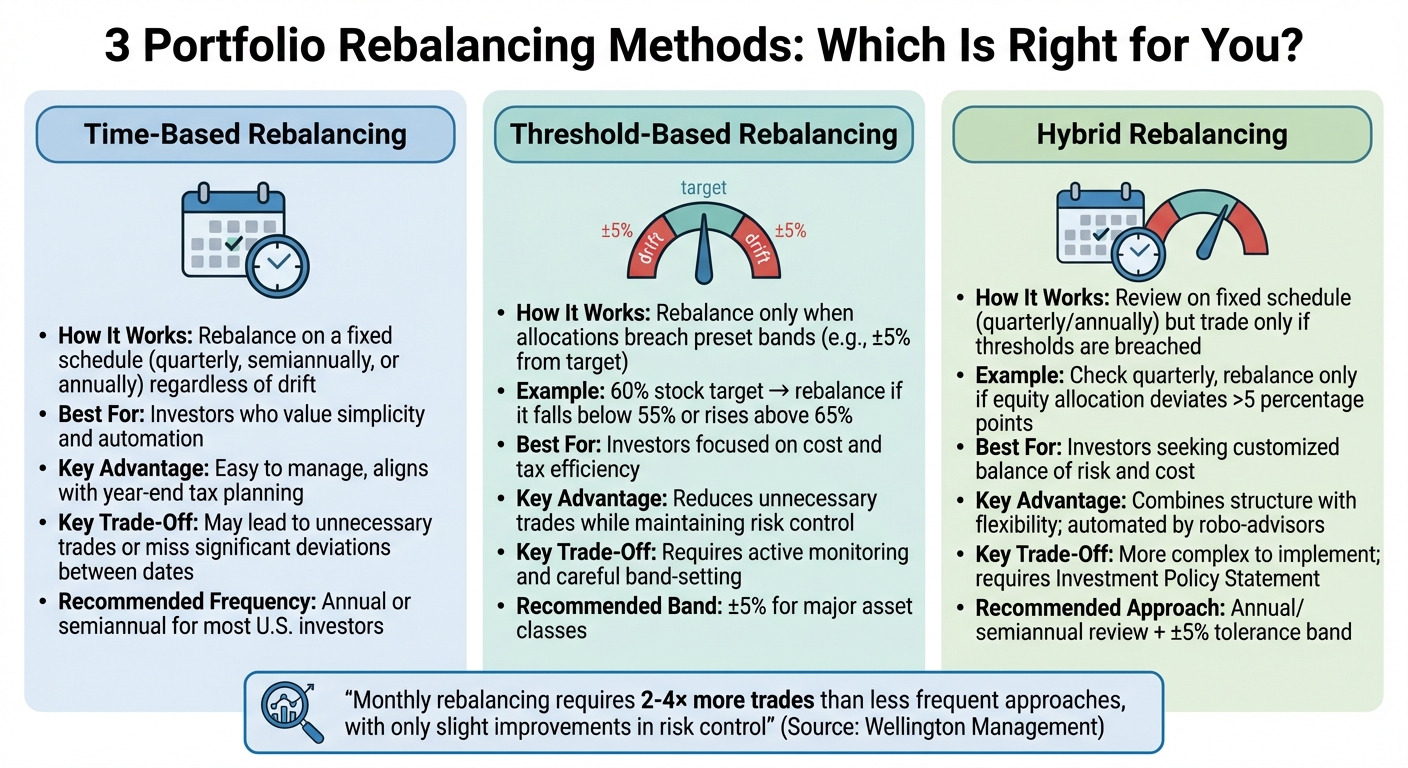

Portfolio Rebalancing Methods Comparison: Time-Based vs Threshold-Based vs Hybrid

Once you've established your target allocation and assessed your risk tolerance, the next step is deciding how to rebalance your portfolio. The right rebalancing method can help you stay aligned with your financial goals while managing risk, trading costs, and taxes. There are three main methods to consider: time-based, threshold-based, and hybrid. Each has its strengths and trade-offs, particularly when it comes to balancing portfolio alignment with minimizing unnecessary trades. For example, research from Wellington Management highlights that monthly rebalancing minimizes deviations from target allocations but requires significantly more trades - up to four times as many - than less frequent approaches, with only slight improvements in risk control. For many U.S. investors, the goal is to find a method that balances risk management with practical cost considerations.

Time-Based Rebalancing

Time-based rebalancing, also known as calendar rebalancing, involves resetting your portfolio to its target allocations on a fixed schedule - such as quarterly, semiannually, or annually - regardless of how much your allocations have drifted. This method is popular for its simplicity and predictability. Many U.S. advisors recommend annual or semiannual rebalancing because it’s easy to manage, aligns well with year-end tax planning, and keeps trading costs under control. In tax-advantaged accounts like 401(k)s or IRAs, quarterly rebalancing might also make sense since capital gains taxes don’t apply.

However, one drawback of this approach is that it doesn’t account for the degree of drift. This means you might end up making trades when adjustments are unnecessary, or you could miss significant deviations that occur between rebalancing dates.

Threshold-Based Rebalancing

Threshold-based rebalancing, or tolerance-band rebalancing, takes a different approach. Instead of following a fixed schedule, this method adjusts your portfolio only when an asset class moves beyond a specified percentage range from its target. For example, if your target allocation for stocks is 60% with a ±5% tolerance band, you would rebalance only if stocks fall below 55% or rise above 65%. This strategy reduces unnecessary trades while keeping your risk levels closer to your intended targets.

Studies show that tighter bands - such as ±2% - can achieve similar risk control as quarterly calendar rebalancing but with fewer trades. However, most experts recommend wider bands, around ±5%, to avoid excessive trading, especially in taxable accounts. When setting these bands, financial planners often use narrower ranges for higher-risk assets like equities and wider ones for more stable holdings like bonds. Some even use asymmetric bands, allowing equities to drift higher during market upswings while limiting downside risks.

Hybrid Rebalancing Approaches

Hybrid rebalancing combines the fixed structure of time-based methods with the flexibility of threshold-based strategies. Under this approach, portfolios are reviewed on a regular schedule, but trades are executed only if allocations breach predefined thresholds. For instance, an advisor might review a portfolio quarterly and rebalance only if the equity allocation deviates by more than 5 percentage points from its target (e.g., dropping below 55% or rising above 65% in a 60/40 portfolio). This method offers a tailored balance between maintaining risk control and managing costs, though it requires careful planning and documentation, often formalized in an Investment Policy Statement.

Many digital platforms and robo-advisors now automate hybrid rebalancing, making it easier for investors to maintain their target allocations without worrying about trading commissions. This approach blends structure with flexibility, helping you manage both risk and cost in line with your broader investment goals.

| Method | How It Works | Best For | Key Trade-Off |

|---|---|---|---|

| Time-Based | Rebalance on a fixed schedule, regardless of drift. | Investors who value simplicity and automation. | May lead to unnecessary trades. |

| Threshold-Based | Rebalance only when allocations breach preset bands. | Investors focused on cost and tax efficiency. | Requires monitoring and setting bands. |

| Hybrid | Combine regular reviews with threshold-based trades. | Investors seeking a customized balance of risk and cost. | More complex to implement. |

For most U.S. investors, a practical approach might involve annual or semiannual rebalancing combined with a ±5% tolerance band for major asset classes. In tax-advantaged accounts, more frequent rebalancing can be done without tax consequences, while in taxable accounts, hybrid strategies - paired with cash flow adjustments like contributions or withdrawals - can help minimize both trading costs and capital gains taxes.

Reducing Costs and Improving Tax Efficiency

Rebalancing your portfolio comes with transaction costs and taxes, both of which can chip away at your returns. Over time, even small expenses can add up, especially if rebalancing is done too frequently. With careful planning, however, you can manage these costs while keeping your portfolio aligned with your goals.

Minimizing Transaction Costs

Using a threshold rebalancing strategy is a good starting point, but keeping costs low is just as important. Transaction costs include things like trading commissions, bid-ask spreads, and market impact. While many U.S. brokerages now offer commission-free trading, other costs, such as bid-ask spreads, still apply. One straightforward way to lower these expenses? Trade less often. For most investors, rebalancing too frequently doesn't justify the costs.

Wider tolerance bands, such as ±5%, can help avoid unnecessary trades. Additionally, you can use natural cash flows - like new contributions, dividends, or withdrawals - to address imbalances. This approach reduces the need for explicit trades and cuts down on transaction costs.

Beyond reducing trading expenses, managing taxes is another critical piece of the puzzle when it comes to preserving your portfolio's returns.

Tax-Loss Harvesting and Tax Efficiency

In taxable accounts, rebalancing can trigger capital gains taxes, which can eat into your returns. U.S. investors pay long-term capital gains rates of 0%, 15%, or 20% on assets held for more than a year, while short-term gains are taxed at ordinary income rates of up to 37%. To mitigate this, tax-loss harvesting can be a valuable strategy. This involves selling securities at a loss to offset gains elsewhere in your portfolio, then reinvesting in similar assets to maintain your allocation.

For instance, if a 60/40 portfolio shifts to 65/35 due to stock gains, you might sell overweight stock positions with embedded losses - say, a position down $5,000 - to harvest those losses. You could then reinvest in similar ETFs to maintain your target allocation. This not only offsets gains from other winners but also helps keep your portfolio balanced. U.S. tax rules allow you to deduct up to $3,000 in net losses against ordinary income annually, with any excess losses carried forward to future years. However, be mindful of the wash-sale rule, which prevents you from claiming a loss if you repurchase a substantially identical security within 30 days before or after the sale.

Combining tax-loss harvesting with threshold-based rebalancing - like a 5% drift trigger - can enhance your after-tax returns by an estimated 0.5-1% annually, according to Vanguard's analysis. In tax-advantaged accounts, such as 401(k)s or IRAs, you don’t have to worry about capital gains taxes, allowing for more flexibility in rebalancing. But in taxable accounts, balancing tax efficiency with cost control is key to building long-term wealth.

sbb-itb-d1a6c90

Tools and Platforms for Custom Rebalancing

Automated Rebalancing Technology

Modern tools have revolutionized custom rebalancing, making it more efficient and precise. These digital platforms monitor target allocations in real time, flagging deviations outside set tolerance bands, and either automating trades or generating actionable trade lists. They also integrate rebalancing with tax-loss harvesting, cash flows, and withdrawals, helping to lower both costs and taxes.

The most effective systems rely on threshold-based monitoring rather than rigid calendar-based schedules. Research indicates that monitoring monthly with a 5% tolerance band can effectively control risk while reducing unnecessary trades. For instance, Wellington's analysis revealed that monthly calendar rebalancing resulted in the lowest deviation from targets but required 2–4× higher turnover compared to threshold-based approaches, leading to higher costs for minimal additional benefits. Advanced platforms also incorporate trade-cost analysis and wash-sale monitoring, further enhancing tax efficiency.

Direct indexing and custom indexing platforms take automation a step further with "smart rebalancing." These tools align trades with opportunities like tax-loss harvesting, new contributions, and dividends, using drift thresholds at various levels - security, sector, or factor. A common starting point is a ±5% band, though wider asymmetric ranges can be used to minimize unnecessary trading while still managing risk effectively. These automated solutions are integral to implementing a customized rebalancing strategy that balances risk and cost management.

BizBot for Financial Management

While leveraging automated platforms is key, managing the costs associated with these tools is equally important. BizBot simplifies this process by offering a comprehensive directory of business administration tools, including subscription management to cut down on unnecessary fees and digital CFO services for streamlined financial operations. This is particularly valuable for small business owners, freelancers, and growing companies who need to balance their investments with running their businesses.

BizBot’s curated categories include popular accounting tools like QuickBooks, Xero, and FreshBooks, as well as business finance platforms that help track expenses and generate financial reports. These tools provide the financial foundation needed for strategic planning, including custom rebalancing. By streamlining financial operations with BizBot, you can focus more on optimizing your portfolio strategy. Effective subscription management and digital CFO services are essential for keeping your overall financial approach efficient and aligned with your goals.

Monitoring and Adjusting Your Rebalancing Strategy

Evaluating Performance and Adjusting Goals

Rebalancing isn’t something you can set and forget. To keep your portfolio aligned with your goals and risk tolerance, it requires regular check-ins. At a minimum, review your allocations annually, and for more active strategies, monitor them quarterly. Track how often your portfolio breaches its tolerance bands, assess portfolio volatility and maximum drawdown compared to a no-rebalancing approach, and evaluate after-tax, after-fee returns to ensure your strategy is delivering value.

Studies show that structured rebalancing - even if done less frequently, like quarterly or semi-annually - can effectively align your portfolio with its targets while avoiding unnecessary turnover. These periodic reviews also prepare you to make timely adjustments as market conditions evolve.

Life changes can be a major reason to revisit your strategy. Events like retirement, receiving an inheritance, selling a business, or changes in income or risk tolerance often call for updating your target allocations and rebalancing parameters. For instance, if you’re five years away from retirement instead of ten, you might reduce your equity exposure or tighten your tolerance bands to lower risk. Similarly, if a business sale results in a significant windfall, you’ll need to reassess whether your current asset mix still aligns with your liquidity needs and investment timeline.

Responding to Market Changes

Market conditions themselves often demand adjustments to your rebalancing strategy. For example, during periods of high volatility, like bear markets, your portfolio may breach thresholds more frequently. On the other hand, in extended bull markets, equities may drift upward, requiring disciplined rebalancing to prevent overexposure to risk.

Experts like Russell Investments suggest using wider rebalancing ranges (±5%) and even asymmetric bands, which allow equities more room to drift upward while limiting downside exposure. This approach helps you capture growth potential while managing risk during volatile times. During such periods, consider using new contributions, dividends, or withdrawals to rebalance. This method minimizes taxable events. Research from T. Rowe Price highlights that monitoring monthly but only rebalancing when allocations deviate by more than 5 percentage points from your target strikes a good balance between maintaining discipline and controlling costs.

Conclusion

Custom rebalancing is all about managing your portfolio's risk while staying aligned with your financial goals. The strategies outlined here work together to help you balance costs, taxes, and investment objectives seamlessly.

Start by setting clear, written goals and defining target allocations that reflect your time horizon and risk tolerance. A hybrid approach - combining annual rebalancing with threshold triggers for significant asset class drifts - offers a practical balance. This method minimizes excessive trading, as quarterly rebalancing often requires 2–4 times more trades than annual adjustments, with only slight improvements in managing drift.

Whenever possible, use new contributions and dividends to buy underweight assets, avoiding unnecessary tax burdens. During market downturns, take advantage of loss harvesting to offset gains. Keep in mind that excessive trading, even a 0.25%–0.50% annual drag, can compound into significant costs over the long term. For business owners managing both operational and investment cash flows, tools like BizBot can simplify the process by offering a consolidated view of accounting, banking, and subscriptions. This integration helps align rebalancing decisions with business liquidity and surplus cash.

Make it a habit to review your portfolio quarterly or semiannually, and schedule a formal strategy review at least once a year - or after major life changes like retirement, selling a business, receiving an inheritance, or experiencing substantial income shifts. While automation and tools can simplify execution, your personal judgment is key for interpreting market conditions and adjusting targets when necessary.

With a disciplined rebalancing strategy, you can turn market volatility into opportunities, reducing stress and keeping your investments on track.

FAQs

What’s the best way to choose a rebalancing strategy for my portfolio?

Choosing how to rebalance your portfolio comes down to your specific goals, how much risk you're comfortable with, and your investment timeline. Two widely used strategies are calendar rebalancing and threshold-based rebalancing:

- Calendar rebalancing means you adjust your portfolio on a set schedule - say, every quarter or once a year. It’s simple, predictable, and easy to incorporate into your financial planning.

- Threshold-based rebalancing kicks in when your asset allocation drifts beyond a certain percentage, like 5%. This method is more flexible and reacts to market movements, helping you manage risk and potentially boosting returns.

Take a close look at your portfolio’s specific needs, keeping in mind market trends and your own preferences, to figure out which approach works best for you.

What should I know about the tax impacts of rebalancing my portfolio?

Rebalancing your portfolio can affect your taxes, and the impact depends on how often and in what way you do it. Rebalancing frequently might trigger more taxable events, which could increase your capital gains taxes. On the flip side, rebalancing less often might delay taxes but could let your portfolio stray from its intended allocation.

To keep taxes in check, you might explore tax-efficient methods like tax-loss harvesting. This strategy involves offsetting gains with losses to lower your taxable income. It’s important to adjust your approach based on your financial objectives and seek advice from a tax professional for guidance tailored to your situation.

What’s the best way to use automated tools for improving my portfolio rebalancing?

Automated tools can make portfolio rebalancing much easier by handling tasks like real-time performance tracking, executing trades based on predefined rules, and reducing the risk of manual mistakes. This means your portfolio can stay aligned with your financial goals without requiring constant attention.

Platforms such as BizBot offer management features that simplify operations, keep track of expenses, and support effective rebalancing strategies. By automating routine tasks, these tools free up your time, allowing you to concentrate on improving your portfolio's overall performance.